New Zealand Problem Gambling Levy

- New Zealand Problem Gambling Levy Rate

- New Zealand Problem Gambling Levy Rates

- New Zealand Problem Gambling Levy Payment

- New Zealand Problem Gambling Levy 2019

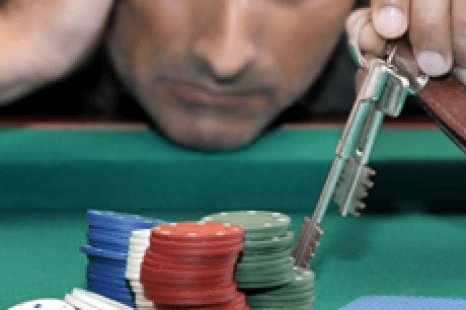

As John watched people coming out the door of a pokie venue, he told me he thought they looked sad. But as John courageously shared his gambling journey with me, it filled me with hope - because he had once walked out of that same venue looking sad. The Gambling (Problem Gambling Levy) Regulations 2019 have been confirmed by Cabinet and will soon be notified in the New Zealand Gazette. The Gambling (Problem Gambling Levy) Regulations 2019 will take effect on 1 July 2019 and introduce the following levy rates (GST exclusive): Gaming Machine Operators (0.78% of player expenditure). The New Zealand Gambling (Problem Gambling Levy) Regulations 2019 have been confirmed by Cabinet. The new regulations come into force on 1 July 2019.

A problem gamblinglevy aimed at addressing harm associated with gamblers’ losses, will apply on pub and club gaming machine, casino, TAB and Lotteries Commission profits from 1 October.

Internal Affairs Minister, George Hawkins, and Associate Health Minister, Damien O’Connor said the regulations include the first problem gambling levy set under the Gambling Act and specific harm minimisation provisions for gambling operators.

Mr Hawkins said the levy was set at various rates for different forms of gambling to reflect the amount of money lost and the level of associated harm.

The rates (GST exclusive) are:

- gaming machines in pubs and clubs, 1.11% of operators’ gross profits

- casinos, 0.51%

- New Zealand Racing Board (i.e. racing, TAB and sports betting), 0.57%

- New Zealand Lotteries Commission, 0.14%.

Mr Hawkins said the Ministry of Health assumed responsibility for funding and coordinating problem gambling services in July and developed an integrated strategy for problem gambling, which includes funding problem gambling services. The cost of delivering the strategy will be reimbursed by the levy.

Mr O'Connor said the Health Ministry would work with Internal Affairs, gambling operators, problem gambling service providers, community groups and other government agencies to prevent and minimise gambling harm and to keep up with changes in the sector.

The Health Ministry will spend a total of $54.5 million over the next three years managing and delivering a strategy that includes primary (public health), secondary and tertiary (interventions) services, as well as research and workforce development, Mr O'Connor said.

Gamblers losses in the year to 30 June 2003 were $1.87 billion up, 12 percent on previous year, with losses for 2004,estimated to top more than $2 billion.

Regulations will also be introduced to minimise harm from gambling and will apply to gaming machines in pubs and clubs, stand-alone TABs not part of pubs, and casinos.

New Zealand Problem Gambling Levy Rate

These regulations will include:

- A definition of unsuitable venues for gaming machines that will mean some venues will no longer be able to host gaming machines. These are venues that are not focused on entertainment or leisure for adults (people over 18 years).

- A ban on automatic teller machines in TABs and the gambling areas of pubs, clubs and casinos.

- A prohibition on advertising and displaying gaming machine jackpots in a way that they can be seen outside the venue.

- Requirements for gaming machines to automatically stop and ask gamblers if they wish to continue gambling or to have their credits paid out.

- Rules for signs in venues.

- Requirements for venue staff to be given problem gambling awareness training.

Copies of the regulations will be available on www.legislation.govt.nz and from bookstores that sell legislation

Internal Affairs

The Gambling (Problem Gambling Levy) Regulations 2019 have been confirmed by Cabinet.

The regulations will introduce new levy rates for the four levy-paying sectors and are planned to come into force on 1 July 2019. The newly confirmed levy rates (GST exclusive) are: gaming machine operators (0.78% of player expenditure); casinos (0.56% of player expenditure); NZ Lotteries Commission (0.43% of player expenditure); and New Zealand Racing Board (0.52% of player expenditure).

New Zealand Problem Gambling Levy Rates

Decisions made on the new levy rates come after the Department of Internal Affairs and the Ministry of Health have consulted with the Gambling Commission, gambling operators, providers of services to prevent and minimise harmful gambling, and other affected groups.

New Zealand Problem Gambling Levy Payment

The Regulatory Impact Assessment and the associated Cabinet paper will be proactively released on the Department of Internal Affairs and Ministry of Health’s website shortly.

New Zealand Problem Gambling Levy 2019

The levy will be used to fund a national strategy and service delivery plan to prevent and minimise gambling harm.